Draft guidance on Trust reimbursement agreements and Unpaid present entitlements

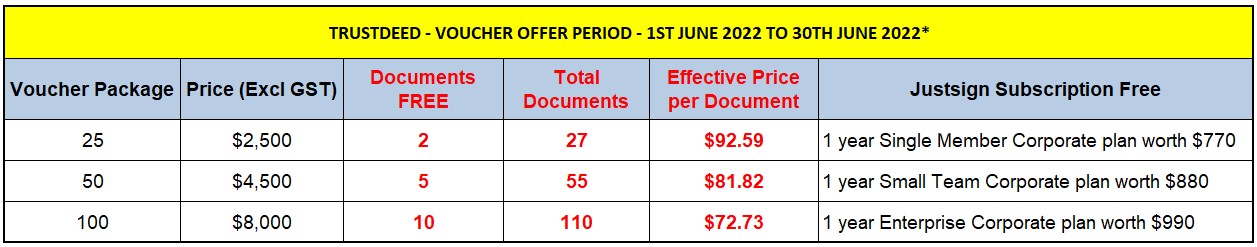

In response to the significant interest received from the community in its draft public advice and guidance relating to trust reimbursement agreements and unpaid present entitlements - section 100A reimbursement agreements, the ATO extended the public consultation period for the guidance, which ended on 29 April 2022. The ATO has provided further update on 5th May 2022 on draft guidance on trust reimbursement agreements and unpaid present entitlements. In the recent update, the ATO Deputy Commissioner Louise Clarke said "the ATO is aware that the guidance – which has been long requested by the tax adviser community – has unsettled some in that community because it calls into question some practices which have been relatively longstanding". "The vast majority of small businesses operating through a trust are not operating in a way that will attract section 100A. A distribution to an adult child who has a low marginal tax rate will not attract section 100A where they simply receive or enjoy the benefit of their distribution". Further clarification was provided by Ms. Clarke that the section can only apply where a distribution is made under an agreement where there will be a payment or other benefit provided to some other entity that will typically have a higher tax rate than the beneficiary, where a purpose of that agreement is that someone will pay less income tax. "For example, where a full-time student receives an entitlement from a trust under an arrangement where they agree to immediately gift the entitlement back to the trustee". Ms. Clarke also said that the section 100A remains as it always has been and they have only published draft guidance for consultation as to how they think the law applies. "The ATO's position is that if the beneficiary of the trust gets the benefit, 100A has no role to play. The ATO is not concerned about ordinary family trusts where the relevant family members benefit from the distributions". Similarly, Ms Clarke also noted that the ATO is not concerned when profits from the family business are distributed to members of the family who work in the management of the business and then that family member chooses to reinvest the profits in the business. The ATO will not be pursuing taxpayers that entered into arrangements between 1 July 2014 and 30 June 2022 where, in good faith, they concluded that section 100A did not apply to them based on the previous 2014 guidance. Ms. Clarke has ressured the community that they stand by their 2014 guidance for the interim period and they won’t have a retrospective element. The ATO will carefully consider all submissions received during the consultation period as it finalises the package of public advice and guidance. Click here to learn more about the draft public advice and guidance. Create a Family DiscretionaryTrust, Unit Trust or Fixed Unit Trust Deed online on our system in less than 20 minutes. Our trust deeds are written in plain English and are easy and simple to read. Set up Discretionary Trust for $148.5 (Incl. GST), Unit Trust $148.5 (Incl. GST), Fixed Unit Trust $275 (Incl. GST) For our current users we have an offer - YOU CAN'T REFUSE!Buy our document voucher package on www.trustdeed.com.au and get more documents FREE!

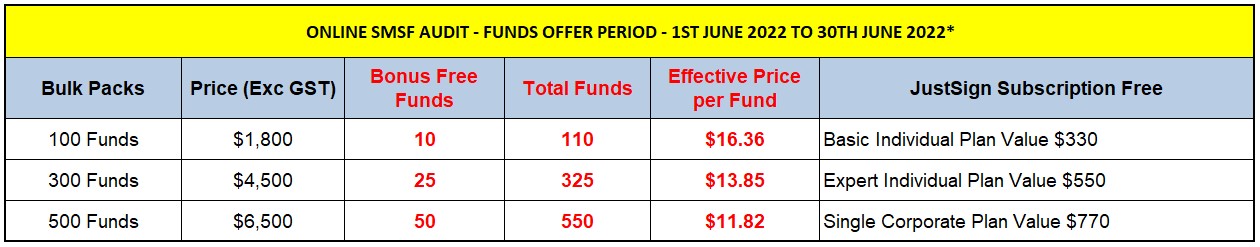

Buy our audit fund packs on www.onlinesmsfaudit.com.au and get more Funds FREE!

The more you buy...the more you get! * If you wish to avail this offer now - please contact us on (02) 96844199. |

| click here to unsubscribe from the mailing list |

Phones are not working due to Optus outage, Please click on Live chat Button.

- $124 + ASIC FEECompany Registration

- Fr $53 + ASIC FEEBusiness Name Registration

- $148.5 (Incl. GST)SMSF

Trust Deed - Fr $165 (Incl. GST)SMSF

Tools- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Commence Account Based Pension

($248.5 incl. GST) - Deed of Confirmation

($248.5 incl. GST) - Add Member to SMSF

($248.5 incl. GST) - Delete Member from SMSF

($248.5 incl. GST) - Change Individual Trustee to Corporate

($248.5 incl. GST) - Change Corporate Trustee to Individuals

($248.5 incl. GST) - Change Corporate Trustee

($248.5 incl. GST) - Declaration of Trust

($220 incl. GST) - SMSF Loan Agreement

($220 incl. GST) - Binding Death Nomination

($75 incl. GST)

- Reduce cost of Documents

- $165 (Incl. GST)SMSF

Borrowing - $97.50 (Incl. GST)Actuarial

Certificate - $495 (Incl. GST)Quantity

Surveyor Rep - Fr $125 (Incl. GST)Trusts

- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Discretionary Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Discretionary Trusts work

- Unit Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Unit Trusts work

- Fixed Unit Trust Deed

($275 incl. GST)

($372.5 incl. GST with Company Trustee) - How Fixed Unit Trusts work

- Why Use Us

- Document Printing

- Reduce cost of Documents

- FreeJobs

- Our

Fees

-

Register a Company or Business Name 24/7,

we have a direct link with ASICHelping you to set up the right business structure online

Fast, Simple and Easy application like never before

Register Now -

Full technical support for Family or Discretionary Trust,

Unit Trust and Fixed Unit TrustFully online, legally compliant trust deed instantly delivered to your inbox

One stop solution for your trust structure needs

Register Now -

Simplify SMSF management & updates

with dedicated SMSF SpecialistCreate the most technically robust

Self Managed Super Fund trust deed, online in less than 20 minutesMake changes easily for smoother running of your SMSF by using our SMSF tools

Register Now -

Get Trusted & Accurate SMSF Borrowing documents

and Actuarial Certificates onlineGet your borrowing documents ready with SMSF Experts

specialised in Limited Recourse BorrowingOrder instant Actuarial certificates online to meet your actuarial certificate requirements

Register Now -

Order a Quantity Surveyor Report online

for your investment property anywhere in AustraliaPhysical visit. No online spreadsheet

Claim maximum for your Investment Property

Register Now

ATO had released a package of draft advice and guidance products in Feb 2022 for further consultation that sets outs their evolving view on the tax treatment of –

ATO had released a package of draft advice and guidance products in Feb 2022 for further consultation that sets outs their evolving view on the tax treatment of –