|

batallion legal

By Luis Batalha, Director

New laws are due to start very soon that could mean that changes need to be made to trust deeds of trusts that own residential property in NSW by midnight on 31 December 2019. If changes are not made, then significant stamp duty and/or land tax will apply to the trustee of the trust, as the trustees of discretionary trusts will then be considered foreign trustees. Since legislation has come in, all our deeds are upgraded to include these provisions Summary of measures A summary of the impact of the measures is below.

Comparison table Changes may need to be made to trust deeds because of the different rates of stamp duty and land tax applicable, in NSW, to foreign persons and non-foreign persons, for residential properties only:

The above stamp duty rates could potentially apply to any property acquired by a trust before 31 December 2019 (and after 31 December 2019). The above land tax rates could apply to the 2017, 2018 and 2019 calendar years. Many land-owning trustees may have already been informed about the changes by Revenue NSW to amend their trust deeds by 31 December 2019. A refund of the higher stamp duty and/or land tax applicable may be available for those trusts that previously paid the higher rate of duty or land tax from the date the higher rates started on 21 June 2016. If the required changes are made to the trust deed of the trust, by midnight 31 December 2019, then a refund of stamp duty and land tax may be applied for to the Revenue NSW. batallion legal can help with applications for a refund. Conclusion The changes proposed to the law regarding making changes to trust deeds have not yet been formally enacted into law. They are currently before NSW Parliament. Once the changes have passed through NSW Parliament though they will become effective from the date they receive Royal Assent. Considering we are nearing the end of the year, however, it is best to arrange for foreign person beneficiaries to be removed now from all discretionary trust deeds, that may own residential property in NSW in the recent past and in the future. While there is a possibility the changes may not pass this year at all, it is better to be safe than sorry and make changes to trust deeds as soon as possible. COST OF VARIATION Email us on info@batallion.com.au with a full copy of the trust deed (and any variations to date) you would like amended, for a quote. batallion legal’s fees start from $330 (GST-inclusive) for a standard trust deed variation.

SMSF ADMIN DOCUMENTS UPGRADED We have upgraded SMSF Admin Documents with more documents, categories & new design on Trustdeed. Please follow below simple steps and you can also access upgraded SMSF Admin design and documents for superfund.

Step 1: Login to https://www.trustdeed.com.au

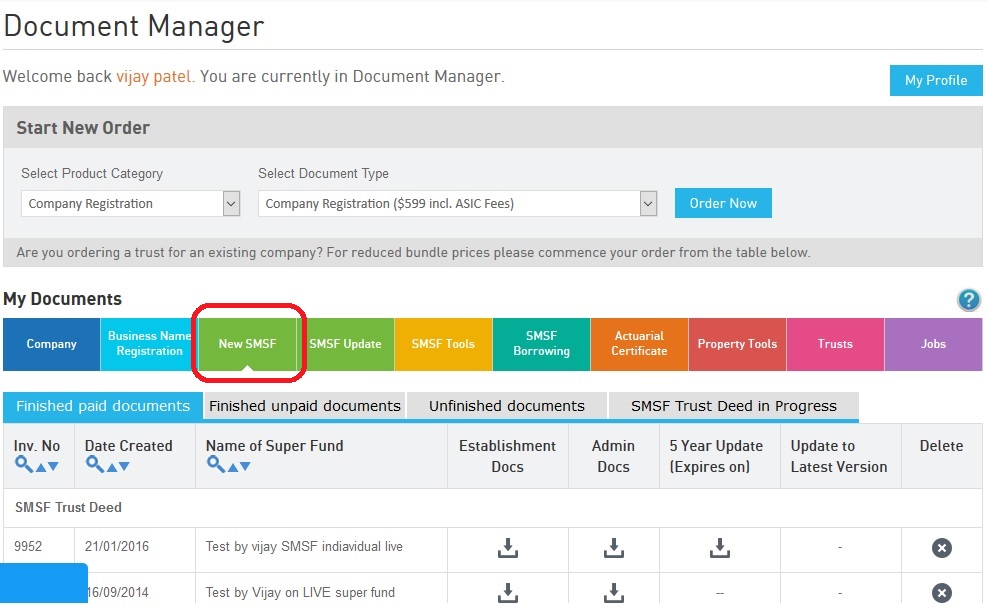

Step 2: Please click on New SMSF under My Documents

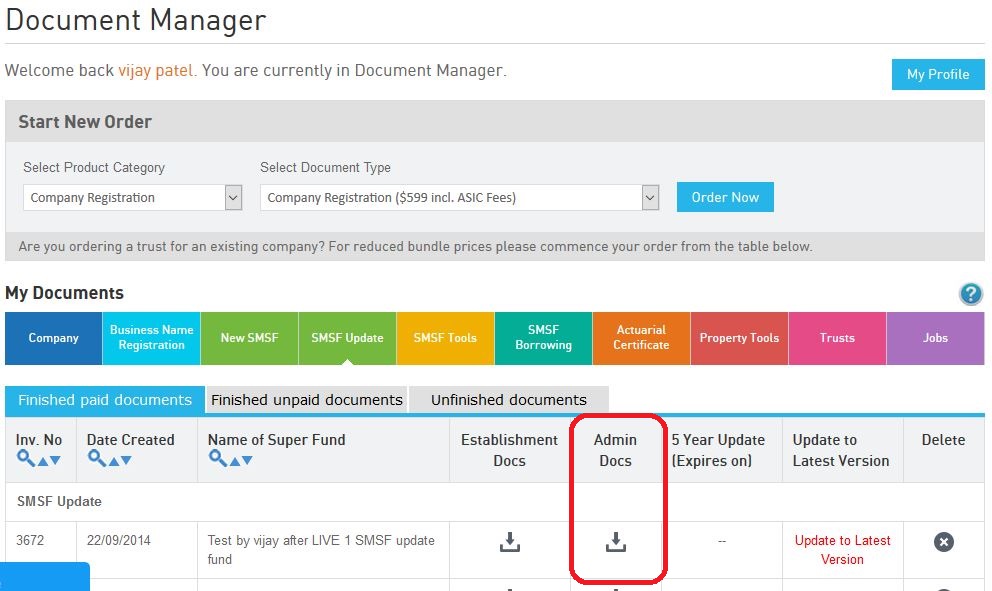

Step 3: Please click on Admin Docs Download button next to super fund

Step 4: SMSF Administration Documents new Design, categories & added new Documents Download document and purpose of Document If you need any help, please call our Support Team on 02 9684 4199. Thank you for continued Support, Team Trustdeed https://www.trustdeed.com.au |

|||||||||||||||||

| click here to unsubscribe from the mailing list |

Phones are not working due to Optus outage, Please click on Live chat Button.

- $139 + ASIC FEECompany Registration

- Fr $55 + ASIC FEEBusiness Name Registration

- $148.5 (Incl. GST)SMSF

Trust Deed - Fr $165 (Incl. GST)SMSF

Tools- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Commence Account Based Pension

($248.5 incl. GST) - Deed of Confirmation

($248.5 incl. GST) - Add Member to SMSF

($248.5 incl. GST) - Delete Member from SMSF

($248.5 incl. GST) - Change Individual Trustee to Corporate

($248.5 incl. GST) - Change Corporate Trustee to Individuals

($248.5 incl. GST) - Change Corporate Trustee

($248.5 incl. GST) - Declaration of Trust

($220 incl. GST) - SMSF Loan Agreement

($220 incl. GST) - Binding Death Nomination

($75 incl. GST)

- Reduce cost of Documents

- $165 (Incl. GST)SMSF

Borrowing - $97.50 (Incl. GST)Actuarial

Certificate - $495 (Incl. GST)Quantity

Surveyor Rep - Fr $125 (Incl. GST)Trusts

- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Discretionary Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Discretionary Trusts work

- Unit Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Unit Trusts work

- Fixed Unit Trust Deed

($275 incl. GST)

($372.5 incl. GST with Company Trustee) - How Fixed Unit Trusts work

- Why Use Us

- Document Printing

- Reduce cost of Documents

- FreeJobs

- Our

Fees

-

Register a Company or Business Name 24/7,

we have a direct link with ASICHelping you to set up the right business structure online

Fast, Simple and Easy application like never before

Register Now -

Full technical support for Family or Discretionary Trust,

Unit Trust and Fixed Unit TrustFully online, legally compliant trust deed instantly delivered to your inbox

One stop solution for your trust structure needs

Register Now -

Simplify SMSF management & updates

with dedicated SMSF SpecialistCreate the most technically robust

Self Managed Super Fund trust deed, online in less than 20 minutesMake changes easily for smoother running of your SMSF by using our SMSF tools

Register Now -

Get Trusted & Accurate SMSF Borrowing documents

and Actuarial Certificates onlineGet your borrowing documents ready with SMSF Experts

specialised in Limited Recourse BorrowingOrder instant Actuarial certificates online to meet your actuarial certificate requirements

Register Now -

Order a Quantity Surveyor Report online

for your investment property anywhere in AustraliaPhysical visit. No online spreadsheet

Claim maximum for your Investment Property

Register Now