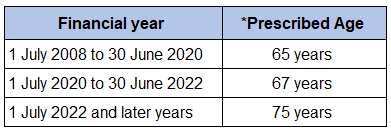

Transfer Balance Cap (TBC) vis-à-vis Total Super Balance (TSB) – How it affects your ability to make Non-concessional Contribution (NCC)Non-Concessional Contribution (NCC) and Cap: NCCs are made from your after-tax income and therefore are not taxed in the fund. Such contribution is subject to maximum cap limit. Any contribution above the cap amount is subject to excess contribution tax at the rate of 47%. As per section 292.85(2) of ITAA 1997, non-concessional contribution cap is equal to four times the concessional contribution cap, if the total superannuation balance (TSB) is less than general transfer balance cap (TBC). In case if the TSB is equal to or exceeds the TBC, then NCC cap for that year will be Nil (section 292.85(2)(b) of ITAA 1997). From 1 July 2021, NCC cap is set to $110,000 ($27,500 multiply by 4). However, for some individuals this cap may be different – it can be higher or nil – depending upon their eligibility to exercise bring-forward arrangements and their total superannuation balance. What is bring forward arrangement? If you make NCCs higher than the cap amount, and your age is less than the prescribed age* – then you may be eligible to bring forward your future NCCs cap up to 3 times of your annual NCC cap limit (i.e., $330,000 for the financial year 2021/22 and onwards), subject to your TSB.

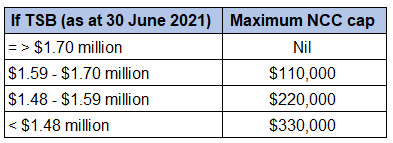

Total Superannuation Balance (TSB) and Maximum Non-concessional Contribution cap Before making any non-concessional contribution to fund, it is important to calculate total superannuation balance to determine your non-concessional contribution cap and eligibility to access bring-forward arrangement. Whether you are eligible to use future NCC cap for up to 2 years or 3 years under bring-forward arrangement depends on your TSB at the end of the previous financial year immediately before the year in which you made a NCC more than cap. Your TSB should not exceed the general transfer balance cap (TBC) of the relevant year. To summarise:

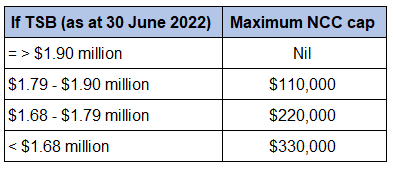

For the financial year 2021/22 and 2022/23, TBC is $1.7 million and accordingly Maximum NCCs cap for the financial year 2022/23 is as under, if the member’s age is less than 75 years:

Calculating Total Superannuation Balance (TSB) LCR 2016/12 provides guidance on how the total superannuation balance is calculated and accordingly, total superannuation balance is the sum of:

As reduced by:

Calculating total superannuation balance is also relevant for determining eligibility for:

Do you know the implications of increase in Transfer Balance Cap (TBC) on Total Superannuation Balance (TSB) in determining your eligibility to use bring forward arrangements?

Are you willing to make contribution in the year 2023/24 and not sure how to determine your maximum NCC cap? Please refer the following checklists to determine your maximum NCC cap.

Example Mr. Rob and Mrs. Rob are having SMSF and have after-tax savings of $110,000 and $330,000 respectively at the end of financial year 30 June 2023. Their age is 65 and 67 years respectively. Their calculated TSB as at 30/06/2023 is $1.80 million and $1.68 million. They want to contribute the same into their Super as on 1 July 2023 for their retirement purpose. But they are not sure how much they can contribute into their super?

Now, lets’ check how much Mr. Rob and Mrs. Rob can contribute into their super for the financial year 2023/24. 1. Check for type of contribution and annual cap limit? - Type of contribution = non-concessional contribution, as members are making contributions from after-tax income. - Annual NCC cap limit = $110,000 ($27,500 multiply by 4) 2. Are you of eligible age? - Member’s age is less than 75 years 3. Calculate your total superannuation balance (TSB). - TSB is less than TBC of $1.9 million 4. Check your eligibility to make contribution more than the maximum cap limit? - In accordance with the table, as illustrated above for 2023/24 financial year - Mr. Rob, maximum NCC cap is $110,000 - Mrs. Rob, maximum NCC cap is $220,000 – she is eligible for 2 year bring-forward arrangement, if she is not currently in active bring forward period. 5. Review your deed to comply with the necessary requirements. - In our SMSF deed relevant requirements have been specified under clause 51 and 63.

Accordingly, Mr. Rob can make NCC up to $110,000 and Mrs. Rob can contribute up to $220,000 only as her TSB is $1.68 million.

In case if Mrs. Rob willing to contribute more than $220,000 then Trustee must refuse to accept the excess concessional contribution in accordance with the clause 53 of our deed. If such contribution received on behalf of the member, then member may request trustee to refuse to accept such contribution in accordance with clause 61 of our deed. In case if contributed to the fund then in accordance with the requirement specified under clause 53 or 61, such contribution must be refunded within the prescribed time limit pursuant to superannuation law. Is your deed updated with the latest changes in the law, if not you can update your SMSF deed to our latest version?Click here to update your SMSF Deed. If you have more than 10 deeds to update, you can request us for the Bulk Updates by subscribing to our voucher packages. Speak to our SMSF specialist today at 02 9684 4199. |

| click here to unsubscribe from the mailing list |

Phones are not working due to Optus outage, Please click on Live chat Button.

- $139 + ASIC FEECompany Registration

- Fr $55 + ASIC FEEBusiness Name Registration

- $148.5 (Incl. GST)SMSF

Trust Deed - Fr $165 (Incl. GST)SMSF

Tools- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Commence Account Based Pension

($248.5 incl. GST) - Deed of Confirmation

($248.5 incl. GST) - Add Member to SMSF

($248.5 incl. GST) - Delete Member from SMSF

($248.5 incl. GST) - Change Individual Trustee to Corporate

($248.5 incl. GST) - Change Corporate Trustee to Individuals

($248.5 incl. GST) - Change Corporate Trustee

($248.5 incl. GST) - Declaration of Trust

($220 incl. GST) - SMSF Loan Agreement

($220 incl. GST) - Binding Death Nomination

($75 incl. GST)

- Reduce cost of Documents

- $165 (Incl. GST)SMSF

Borrowing - $97.50 (Incl. GST)Actuarial

Certificate - $495 (Incl. GST)Quantity

Surveyor Rep - Fr $125 (Incl. GST)Trusts

- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Discretionary Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Discretionary Trusts work

- Unit Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Unit Trusts work

- Fixed Unit Trust Deed

($275 incl. GST)

($372.5 incl. GST with Company Trustee) - How Fixed Unit Trusts work

- Why Use Us

- Document Printing

- Reduce cost of Documents

- FreeJobs

- Our

Fees

-

Register a Company or Business Name 24/7,

we have a direct link with ASICHelping you to set up the right business structure online

Fast, Simple and Easy application like never before

Register Now -

Full technical support for Family or Discretionary Trust,

Unit Trust and Fixed Unit TrustFully online, legally compliant trust deed instantly delivered to your inbox

One stop solution for your trust structure needs

Register Now -

Simplify SMSF management & updates

with dedicated SMSF SpecialistCreate the most technically robust

Self Managed Super Fund trust deed, online in less than 20 minutesMake changes easily for smoother running of your SMSF by using our SMSF tools

Register Now -

Get Trusted & Accurate SMSF Borrowing documents

and Actuarial Certificates onlineGet your borrowing documents ready with SMSF Experts

specialised in Limited Recourse BorrowingOrder instant Actuarial certificates online to meet your actuarial certificate requirements

Register Now -

Order a Quantity Surveyor Report online

for your investment property anywhere in AustraliaPhysical visit. No online spreadsheet

Claim maximum for your Investment Property

Register Now

With effect form 1

With effect form 1