The advice provided on this newsletter and the links to the websites is general advice only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. If any products are detailed on this website, you should obtain a Product Disclosure Statement relating to the products and consider its contents before making any decisions.

Deed Dot Com Dot Au Pty Ltd disclaim all and any guarantees, undertakings and warranties, expressed or implied, and shall not be liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or consequential loss or damage) arising out of or in connection with any use or reliance on the information or advice on this newsletter. The reader must accept sole responsibility associated with the use of the material on this newsletter, irrespective of the purpose for which such use or results are applied. The information on www.trustdeed.com.au is no substitute for financial advice.

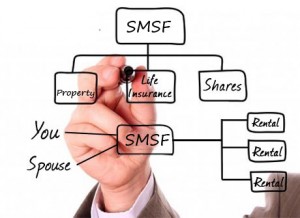

Till date, it is not a public ruling meaning that it is not binding. Primarily, it is designed as a “safe harbour protection” for SMSF trustees with related party loans under a Limited Recourse Borrowing Arrangement (LRBA).

Till date, it is not a public ruling meaning that it is not binding. Primarily, it is designed as a “safe harbour protection” for SMSF trustees with related party loans under a Limited Recourse Borrowing Arrangement (LRBA).  The total repayment then works out to $317,208(the $210,000 principal amount + the $107,208 interest payment for the year) which is indeed a very large sum. This brings us to the obvious question: does the SMSF have the cash to repay the debt? If not, the members of the SMSF must make sufficient contributions so to make the repayment possible.

The total repayment then works out to $317,208(the $210,000 principal amount + the $107,208 interest payment for the year) which is indeed a very large sum. This brings us to the obvious question: does the SMSF have the cash to repay the debt? If not, the members of the SMSF must make sufficient contributions so to make the repayment possible..png)

.jpg) Between 11 am and 3 PM - Lunch Provided

Between 11 am and 3 PM - Lunch Provided