|

Audits on the top 100 SMSF auditorsAs part of our self-managed super funds (SMSFs) compliance program we review the top 100 auditors who between them audit 33% of the total population of SMSFs, representing around $186 billion in assets. Each of these auditors audit more than 500 funds a year and on average audit 1,500 SMSFs. We audit this group to seek assurance that this large proportion of SMSFs receive a proper and adequate audit and that this group of auditors are meeting their statutory obligations. A particular focus of a top 100 SMSF auditor compliance review is to understand and gain assurance about the methods, processes and controls in place that allow the SMSF auditor to sign off on a large number of audits annually. At the end of the 2018–19 financial year we completed reviews on 51 of the top 100 auditors, looking at three to five SMSF audit files for each of these auditors. Results of those reviews were as follows:

No further action – 10 auditorsWe found 10 auditors to be fully compliant and no further action was necessary. Their audit files contained all relevant working papers and sufficient appropriate evidence to support their opinions formed in relation to the financial and compliance audit. (Manoj Abichandani: 6 Auditors who use our software www.onlinesmsfaudit.com.au and audit more than 1500 funds (some close to 4,000 funds) on our software have informed us that they have no issues with the ATO)

Education outcome – 36 auditorsThere were 36 auditors who required further education which they received by letter. Deficiencies across this group included:

Voluntary deregistration – three auditorsThree auditors voluntarily deregistered once we commenced our audit. ASIC referrals – two auditorsTwo auditors were referred to ASIC because they had failed to obtain sufficient appropriate audit evidence to verify the fund’s compliance with the relevant super laws. ASIC has since imposed conditions on the registration of one of the auditors under section 128D and we're awaiting an outcome of the referral with respect to the other auditor. ConclusionAuditors play an integral role in helping protect SMSF members’ retirement benefits and must comply with their statutory obligations and complete proper and adequate audits. Apart from the two auditors we referred to ASIC, the deficiencies identified in the remaining top 100 auditor population who received education did not warrant a referral to ASIC. However, we're concerned that some auditors failed to obtain sufficient appropriate audit evidence or failed to evaluate the evidence in order to demonstrate how the auditor arrived at their opinion on the financial and compliance audit. We're also concerned with the number of unsigned financial statements we found and the lack of other documents that should be on the audit file, such as a signed trustee representation letter, engagement letter and in some cases, a management letter.Auditors who received an education outcome will continue to be monitored and will be reviewed in another two to three years. If we find they've failed to improve their auditing processes, they may be referred to ASIC for further action. We hope to complete the remaining 49 top 100 auditor reviews by the end of this financial year.

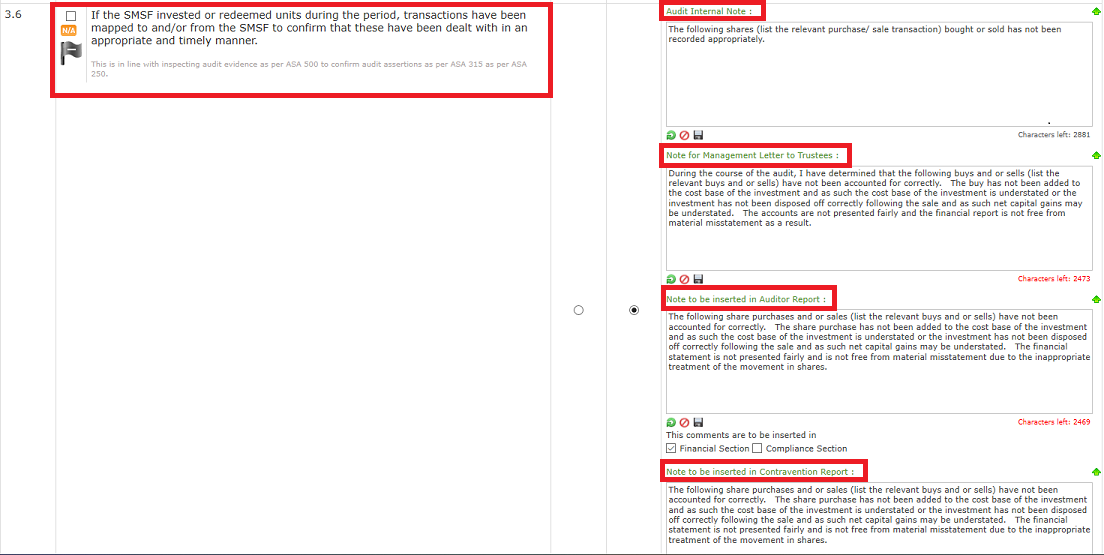

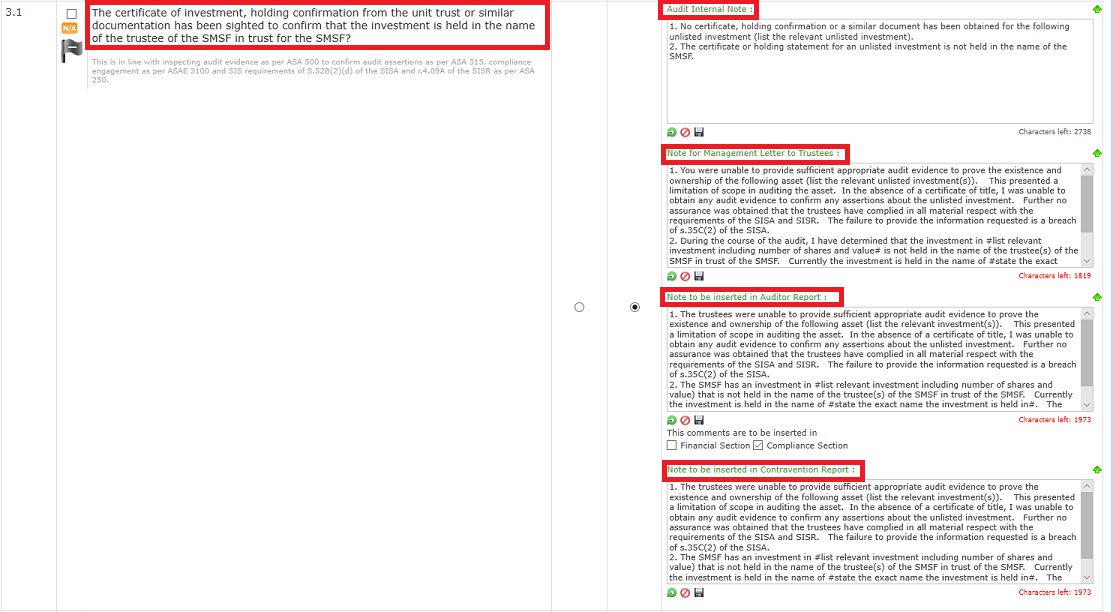

Had the 36 Auditors used OnlineSMSFaudit.com.au .... All the deficiencies in their audit could be discovered or exposed by the software - below is one of the issue - where the auditor would have conducted a top quality audit - and also able to adequately document their evaluations of the evidence in the audit file such that we could be satisfied they had appropriately formed an opinion on the fund’s compliance with the relevant super laws.

The software is free to try for 5 SMSF Audits - simply register yourself and and check out the software for yourself - you can also attend our Demo of the software on When :19th December 2019 at 2:00 PM Sydney Time

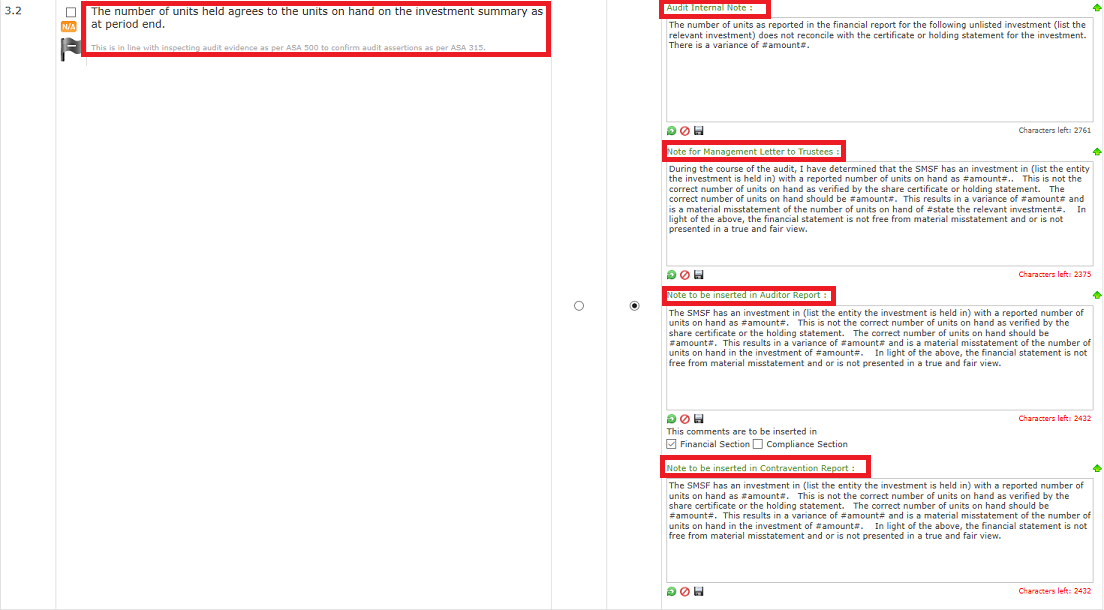

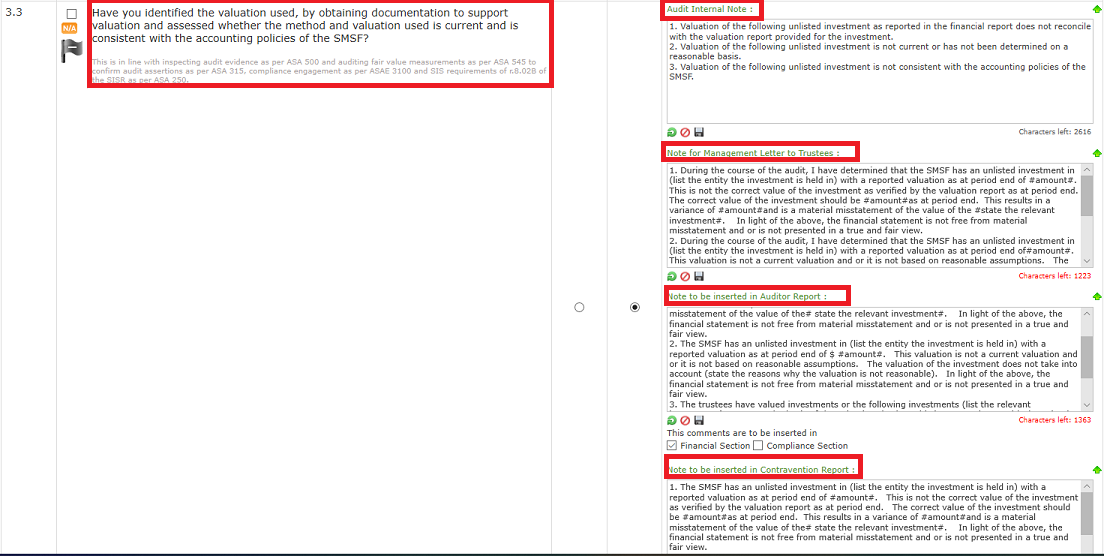

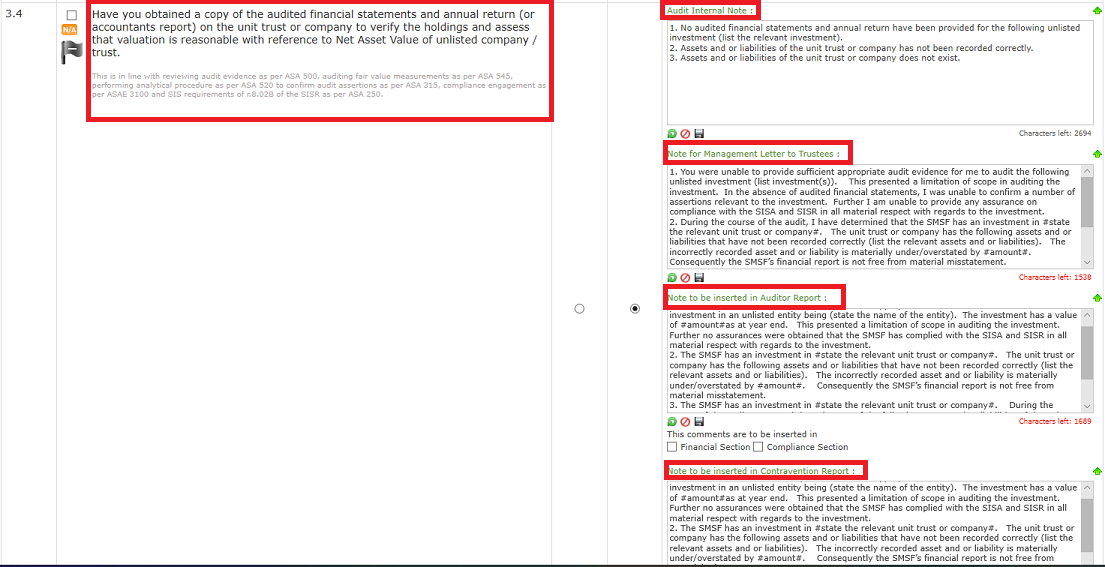

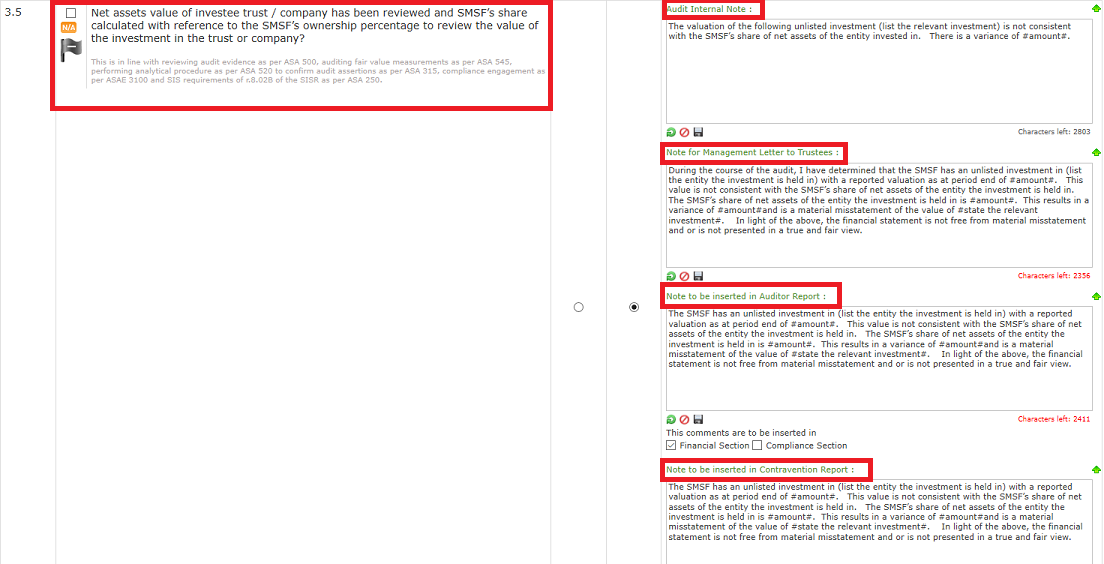

Below screens of working papers from onlinesmsfaudit.com.au software to address the above issue of auditing Unlisted Trusts:

|

| click here to unsubscribe from the mailing list |

Phones are not working due to Optus outage, Please click on Live chat Button.

- $139 + ASIC FEECompany Registration

- Fr $55 + ASIC FEEBusiness Name Registration

- $148.5 (Incl. GST)SMSF

Trust Deed - Fr $165 (Incl. GST)SMSF

Tools- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Commence Account Based Pension

($248.5 incl. GST) - Deed of Confirmation

($248.5 incl. GST) - Add Member to SMSF

($248.5 incl. GST) - Delete Member from SMSF

($248.5 incl. GST) - Change Individual Trustee to Corporate

($248.5 incl. GST) - Change Corporate Trustee to Individuals

($248.5 incl. GST) - Change Corporate Trustee

($248.5 incl. GST) - Declaration of Trust

($220 incl. GST) - SMSF Loan Agreement

($220 incl. GST) - Binding Death Nomination

($75 incl. GST)

- Reduce cost of Documents

- $165 (Incl. GST)SMSF

Borrowing - $97.50 (Incl. GST)Actuarial

Certificate - $495 (Incl. GST)Quantity

Surveyor Rep - Fr $125 (Incl. GST)Trusts

- Reduce cost of Documents

$55.00 - Pay By Vouchers - Information

- Discretionary Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Discretionary Trusts work

- Unit Trust Deed

($148.5 incl. GST)

($250 incl. GST with Company Trustee) - How Unit Trusts work

- Fixed Unit Trust Deed

($275 incl. GST)

($372.5 incl. GST with Company Trustee) - How Fixed Unit Trusts work

- Why Use Us

- Document Printing

- Reduce cost of Documents

- FreeJobs

- Our

Fees

-

Register a Company or Business Name 24/7,

we have a direct link with ASICHelping you to set up the right business structure online

Fast, Simple and Easy application like never before

Register Now -

Full technical support for Family or Discretionary Trust,

Unit Trust and Fixed Unit TrustFully online, legally compliant trust deed instantly delivered to your inbox

One stop solution for your trust structure needs

Register Now -

Simplify SMSF management & updates

with dedicated SMSF SpecialistCreate the most technically robust

Self Managed Super Fund trust deed, online in less than 20 minutesMake changes easily for smoother running of your SMSF by using our SMSF tools

Register Now -

Get Trusted & Accurate SMSF Borrowing documents

and Actuarial Certificates onlineGet your borrowing documents ready with SMSF Experts

specialised in Limited Recourse BorrowingOrder instant Actuarial certificates online to meet your actuarial certificate requirements

Register Now -

Order a Quantity Surveyor Report online

for your investment property anywhere in AustraliaPhysical visit. No online spreadsheet

Claim maximum for your Investment Property

Register Now